Tax Return

The creation of a company is a project that requires a lot of preparation, a bad decision could have an impact on the future of the company...

Read moreBUSINESS CREATION

The creation of a company is a project that requires a lot of preparation, a bad decision could have an impact on the future of the company...

Read moreAccounting and Salary Management

Accounting is a financial data management tool that lets companies and organizations such as associations and...

Read moreVAT RETURN

The value-added tax is an indirect tax collected and perceived by the confederation at different stages of production and distribution...

Read moreCorporate Tax Retun

According to the Swiss law, the word legal entity comprises limited liability companies, limited companies...

Read moreLegal entity tax return

According to Swiss law, the term legal entity includes liability companies

Read more

How is inflation behaving in Switzerland?

28 May 2025

What impact do SMEs have on the Swiss economy?

28 May 2025

Geneva rejects tax increases

28 May 2025

Investing in the Swiss stock market

28 May 2025

Investing in Switzerland

28 May 2025

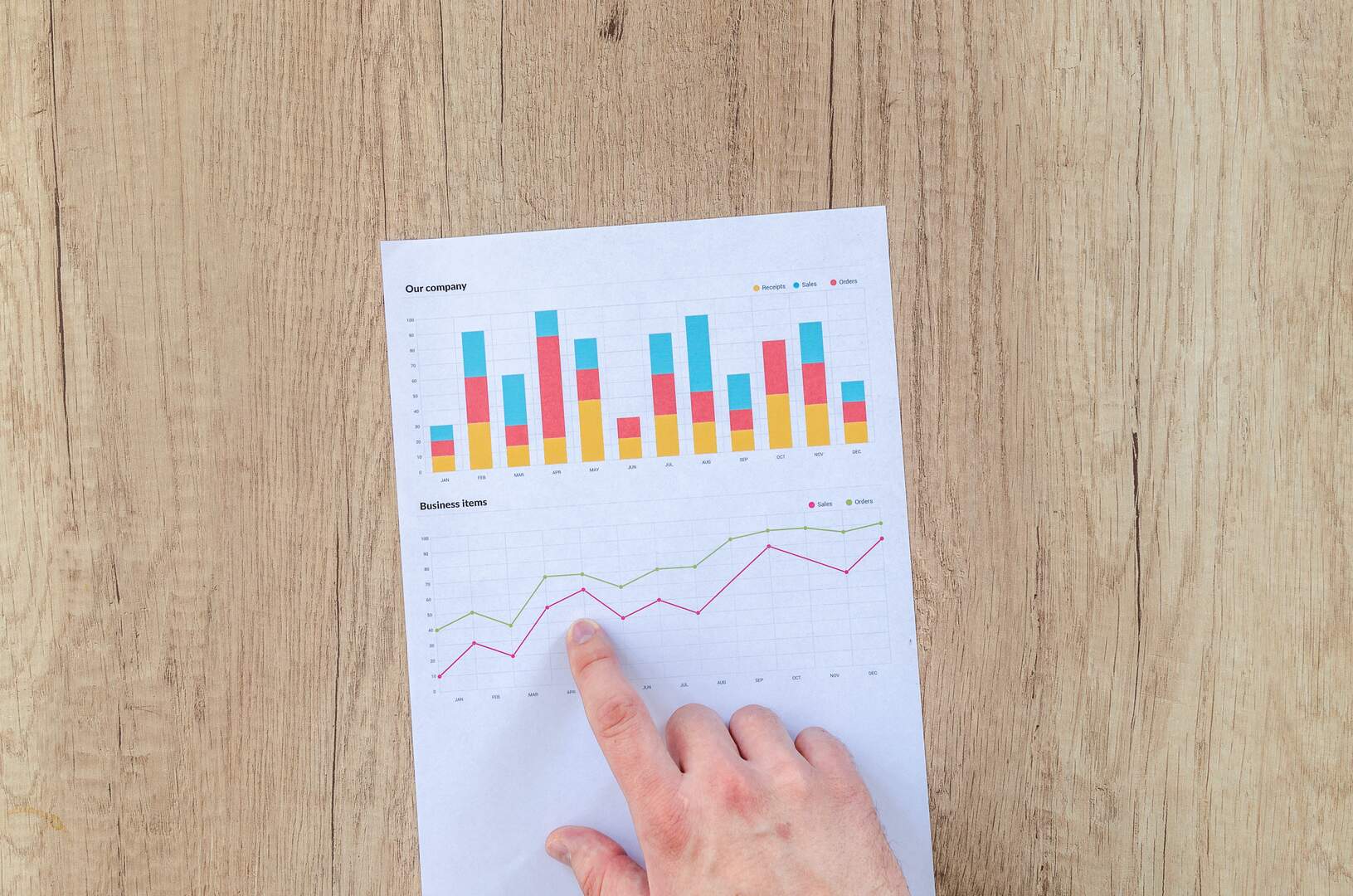

What impact do SMEs have on the Swiss economy?

What impact do SMEs have on the Swiss economy? Switzerland is an economically prosperous country. In fact, according to the World Bank, it is the 17th largest economy in the world. There are many factors that explain its rise. Switzerland owes this fine performance to its innovative education system, which trains around two-thirds (2/3) of its young people every year. Unemployment is negligible. Its industrial system is characterised by a high export rate. This enables it to make a good profit margin thanks to international transactions. Its GDP is 7.6%, making it the world's leading exporter. Small and medium-sized businesses are also a great support to this nation's economy. Fi...

28 May 2025

Contribution to the 3rd pillar

The 3rd pillar is an old-age, survivors' and invalidity pension scheme included in the Swiss constitution. Its main purpose is to supplement 1st and 2nd pillar income. Unlike the 1st and 2nd pillars, the maximum linked 3rd pillar contribution for employees is CHF 6,826 per year, rising to 20...

Read more

Contribution to the 2nd pillar

Contributing to the 3rd pillar to pay less tax in Switzerland: an essential strategy In Switzerland, tax optimisation is a major issue for many taxpayers. Against this backdrop, the 3rd pillar is a simple, effective and affordable way to reduce your tax burden while preparing for retirement. Thi...

Read more

Favouring or opting for rental

In Switzerland, housing is more than just a lifestyle choice. Buying or renting a property has major tax implications. This choice not only affects your monthly budget, but also your income tax, wealth, tax-deductible expenses and sometimes your retirement strategy. In this dossier, we help you ...

Read more

Claiming dependants

Claiming dependants on your tax return is an excellent way of reducing your taxable income. The Swiss tax system recognises that a taxpayer who supports children, a non-earning spouse or needy relatives has additional expenses. This is why it provides for specific deductions and sometimes more ad...

Read more

Deduction of donations

🎁 Donation deduction: what you can really deduct from your tax in Switzerland Making a donation is an act of solidarity... but it's also a legally recognised way of reducing your tax burden. In Switzerland, donations to certain organisations can be deducted from your taxable income, provi...

Read more

Working as a freelancer

Working as a self-employed person in Switzerland offers many freedoms, but it also comes with a specific tax framework. Unlike an employee, a self-employed person is taxed on his or her net profits and can deduct a certain number of professional expenses. Optimising your tax position is therefore...

Read moreLatest Articles

More newsWhy are VAT rates being increased in Switzerland?

Why are VAT rates increasing in Switzerland? VAT, or value added tax, is an indirect tax levied on the consumption of goods and services. In Switzerland, as in many other countries, VAT is an essential component of public finances. The increase in VAT rates in Switzerland, effective from 1 Janua...

Read moreIntroduction to accounting

Introduction to accounting Accounting is a system for organising financial information, making it possible to enter, classify and record basic numerical data. After appropriate processing, this discipline also provides a set of information that meets the needs of the various users. Accounting wo...

Read moreIncome statement

The profit and loss account: the essential tool for any business; In order to monitor the development of your business, particularly if it is an SME, it is important to keep track of its income and expenses. This also enables you to compare it with other companies or with previous financial yea...

Read moreWhy is the 3ᵉ pillar important before retirement?

Why is the 3ᵉ pillar important before retirement? The 3ᵉ pillar refers to optional individual retirement savings that supplement the 1ᵉʳ and 2ᵉ pillars of the Swiss old-age pension system. In practical terms, it involves building up additional capital to optimise your income after you s...

Read moreHow do you ensure the succession of your SME?

How do you ensure the succession of your SME? A successful entrepreneur is not immune to the unexpected, such as a serious illness or accident. Quick action is essential. Here are the best recommendations for selling your business at the right time. Start succession planning as early as the age...

Read more